Written by Reporter Larry Schlesinger, Australian Financial Review 26 September 2022

Frasers Property Industrial boss Ian Barter says his latest acquisition – a 74-hectare super site in Kemps Creek in Sydney’s tightly held western corridor – shows the developer and investor is on track to double its $5.5 billion Australian portfolio within five years.

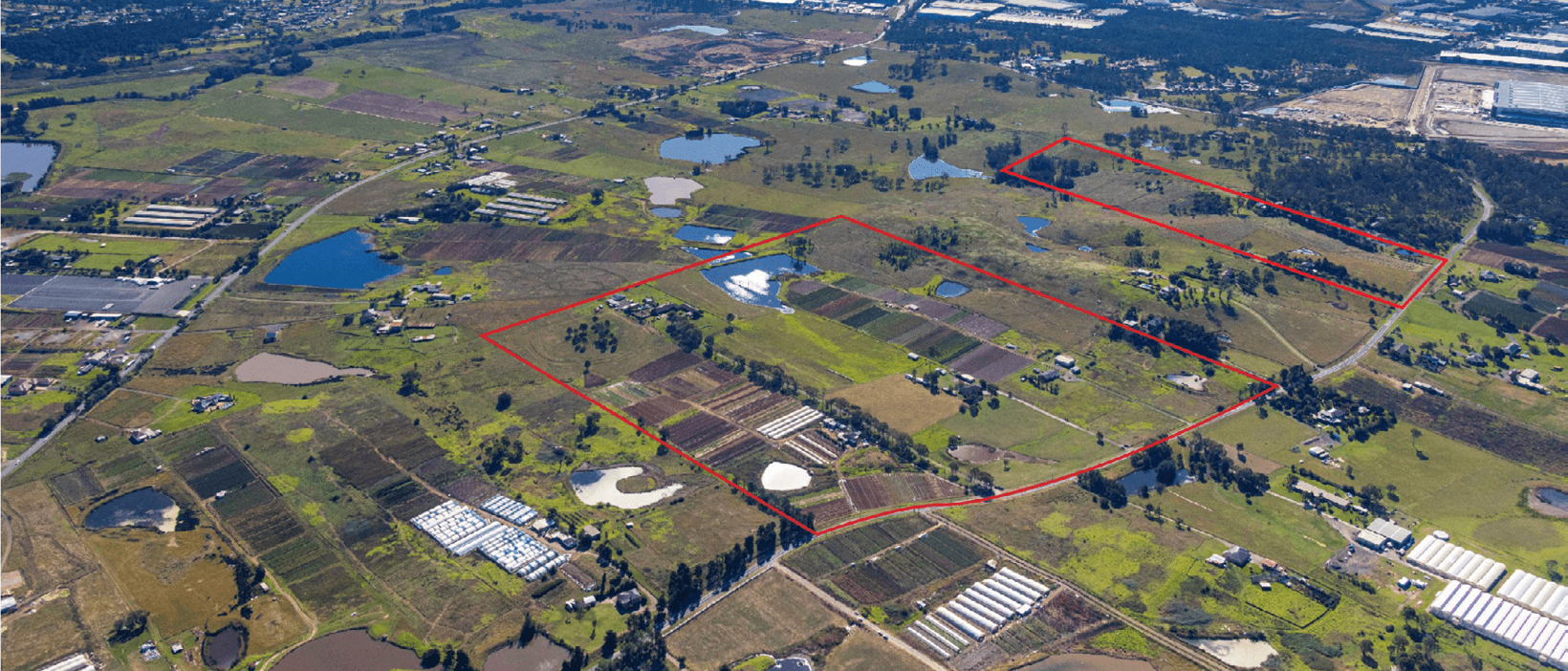

Running along Aldington Road in the Mamre Road industrial precinct, the Kemps Creek site Frasers Property acquired for an undisclosed sum will support about 450,000 square metres of new logistics facilities with an end value of more than $1 billion.

It adds to 15 projects with an end value of $1.3 billion coming out of the ground across Australia, double the size of Frasers Property Industrial's pipeline a year ago. Frasers Property Industrial's 2.3-million square metre land bank will produce a further $4.1 billion of premium-grade product once fully developed.

As with rivals Goodman Group, ESR, Logos and Charter Hall, Frasers Property Industrial has ridden the tailwinds of the e-commerce-driven logistics boom, where demand for warehouse space has outpaced supply, sending vacancy rates tumbling to record lows and driving double-digit annual rental growth.

“We have a $5.5 billion portfolio in Australia, 98 per cent of which we have developed ourselves. It’s all brand-new facilities with quality [leasing] covenants,” Mr Barter told The Australian Financial Review.

“We’d be disappointed if we didn’t double that in four to five years’ time,” he said.

A specialist business unit of Singapore-listed real estate giant Frasers Property Limited, which has about $44 billion of assets under management, Frasers Property Industrial has its roots in the commercial and industrial division of former ASX-listed Australand Property Group, which Frasers acquired in 2015.

The majority of Frasers Property Industrial's portfolio is focused on Australia’s east coast where it has developed large, state-of-the-art facilities for clients including Techtronic Industries, Symbion, ASX-listed IVE Group, National Tiles and Goodyear.

“We’ve traditionally done a lot of pre-committed facilities and then off the back of that, some speculative product,” Mr Barter said.

“But this new estate will have a higher percentage of speculative development, given the low vacancy rate in the precinct. We will create a more generic product, where we can attract a rental premium,” he said.

Highlighting the strength of the industrial market, Frasers Property Industrial's existing portfolio is 100 per cent leased. Mr Barter said rents were rising strongly across all markets.

“The biggest increases are occurring in Sydney, especially in the west, where the vacancy rate is close to zero, and in Melbourne. Rental growth is also pretty strong in Brisbane,” Mr Barter said.

He said tenants were more focused on servicing their customers in the most efficient manner than on getting the cheapest rents.

The new estate to be developed at Kemps Creek will flow on from the nearby 118ha The Yards estate, which Frasers Property Industrial is developing with Altis Property Partners and Aware Super.

The Aldington Road site is a consolidation of seven individual blocks, the majority of which Frasers Property Industrial secured under option agreements a few years ago, before the latest surge in Western Sydney land values to about $450 per square metre.

Frasers Property Industrial did not disclose what it paid for the Kemps Creek site, but property records show the developer has spent more than $150 million on land on Aldington Road since July last year.

Frasers Property Industrial plans to develop between 15-20 facilities on the new estate as well as health and wellbeing amenities including green space, outdoor exercise equipment, and food and beverage outlets.

As with its other estates, Frasers Property Industrial will target a 5-Star Green Star rating from the Green Building Council of Australia.

Mr Barter said Frasers Property Industrial decided many years ago to take a leading position on sustainability in the industrial property sector. Since 2015, it has installed 10 megawatts of solar power generation on its estates, the equivalent of taking 2500 cars off the road every year.

“We’re focused on carbon reduction – both ours and our tenants’,” he said.